Introduction: Grasping the Pulse of the Industry in the Tide of Change

As the global pharmaceutical industry accelerates toward its 2025 goals, the pharmaceutical intermediates sector is caught in a multidimensional tug-of-war: on one side is the unprecedented surge in demand driven by innovative therapies, while on the other is the systemic pressure brought about by the transition to carbon neutrality and geopolitical restructuring.

This article delves into six disruptive trends, mapping out a strategic roadmap for industry participants to navigate the cycle.

The Reconfiguration of Asia’s Manufacturing Landscape: India and Southeast Asia’s Dual Breakthroughs

While China continues to dominate global intermediate production capacity, the regional competitive landscape is evolving with new characteristics:

India’s Quality Revolution: The PLI 2.0 program is investing $2.5 billion to establish 12 specialized API parks, aiming to achieve a 30% self-sufficiency rate for basic drug intermediates by 2025. Cities like Hyderabad and Ahmedabad are forming cGMP-certified clusters.

Southeast Asia’s Cost Advantage: Vietnam is attracting Sanofi to establish a factory through its “Four Exemptions and Nine Halves” tax incentives, while Malaysia’s Penang zone is leveraging its EHS compliance advantages to become a regional supply hub for Merck and Novartis.

Continuous Flow Technology Boom: The Inflection Point in Reconstructing Production Paradigms

Batch processing is facing a historic wave of replacement. By 2025, continuous flow technology will penetrate 40% of intermediate production:

Efficiency Revolution: Modular reactors reduce the synthesis cycle of ADC drug linkers by 60% and increase batch capacity by threefold.

Quality leap: Online PAT systems enable real-time monitoring of over 100 parameters, with a certain company’s cephalosporin intermediate batch pass rate increasing from 87% to 98.5%

AI Synthetic Biology: Reshaping the R&D Innovation Curve

The integration of machine learning and biomanufacturing is rewriting the rules of molecular construction:

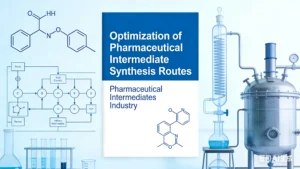

Intelligent route design: An AI platform used reverse synthesis analysis to compress the synthesis steps of a core heterocyclic intermediate for an anticancer drug from seven to four, improving atomic economy by 35%.

Predictive Quality Control: An impurity prediction model based on LSTM neural networks reduced a company’s QC costs by 18% and shortened the R&D cycle by 40%.

Innovative Practices: A joint laboratory established with MIT developed the world’s first AI-driven continuous-flow biocatalytic system, achieving 99.9% ee selectivity in the synthesis of a chiral intermediate.

Carbon Neutrality Transition: Compliance Costs Determine Survival Boundaries

The global carbon regulatory network is reshaping industrial competition rules:

Carbon tax impact: After the implementation of the EU CBAM, a certain company calculated that the cost of exporting sartan intermediates to Europe would increase by 12.7%, forcing a full-process low-carbon transformation.

Water crisis response: Maharashtra, India, has mandated the implementation of ZLD systems. A certain company achieved zero wastewater discharge through mechanical vapor recompression (MVR) technology, saving 450,000 cubic meters of water annually.

Sustainability Model: A factory has built a solar microgrid + green hydrogen energy storage system, achieving annual carbon emissions reductions equivalent to planting 280,000 trees, and has thus obtained Pfizer’s 2025 strategic supplier qualification.

Nearshore Outsourcing Upgrade: The 500-Mile Supply Chain Revolution

Under the dual impact of geopolitics and the pandemic, supply chain布局 has taken on new characteristics:

Americas Dual Circulation: Monterrey, Mexico, and Ontario, Canada, form a complementary structure, with the former handling 65% of U.S. pharmaceutical formulation intermediates and the latter focusing on high-barrier HPAPI production.

European Corridor Reconstruction: The Barcelona, Spain-Setubal, Portugal axis is emerging, leveraging EU single market access and low-cost advantages to attract Roche and Bayer to establish regional supply centers.

Solution: A company has established a “EU factory + North American strategic partner” dual-cycle system, successfully helping clients pass the IRA Act’s localization production review, with inventory turnover rates increasing by 38%.

Biomanufacturing Boom: The Critical Point from Laboratory to Industrialization

Breakthroughs in synthetic biology technology are opening up a trillion-dollar market opportunity:

Precision fermentation revolution: A company has modified glutamic acid bacillus to replace the E. coli system for a monoclonal antibody precursor, reducing production costs by 72% compared to CHO cell culture.

Biomass conversion breakthrough: A biosynthetic route for an antibiotic intermediate using sugarcane molasses as raw material reduces carbon emissions by 83% compared to the petrochemical route and avoids price volatility risks associated with corn and other food-based raw materials.

Future Challenges and Responses

Talent War: Chemical engineers in emerging markets like India and China command salary premiums of 15-20%. A company implemented a “Global Mentor Program” to achieve a 91% talent retention rate.

Registration Barriers: With 32 countries having differentiated DMF registration requirements, a company has developed an intelligent compliance system that automatically generates submission documents compliant with each country’s pharmaceutical regulatory formats.

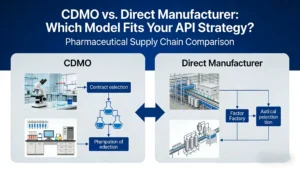

Vertical Integration Opportunities: Amid the merger and acquisition wave between CDMOs and generic drug companies, a company has achieved vertical integration from API to finished dosage forms by acquiring a European GMP intermediate factory, resulting in an 8-percentage-point increase in gross margin.

Conclusion: Forging Core Capabilities Amid Industry Transformation

The 2025 intermediates market will be the ultimate test of strategic foresight and technological penetration. Leading companies must navigate five key variables: restructuring manufacturing networks in Asia, disrupting cost curves with continuous flow technology, establishing technological advantages through AI biotechnology, integrating carbon neutrality into their business DNA, and building ecological barriers through vertical integration.

As a professional service provider with 25 years of industry expertise, we prioritize quality as the foundation, offering clients end-to-end solutions from molecular design to global supply. Facing this uncertain turning point, are you ready to turn market volatility into strategic advantage?

Take action now: Visit our [Technology Solutions Center] or schedule a free supply chain diagnosis with an expert. Let us help you seize the initiative in the 2025 industry transformation and turn challenges into new growth momentum.