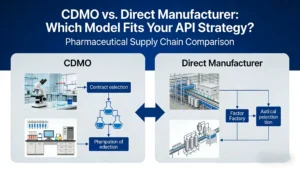

CDMO vs. Direct Manufacturer: Which Model Fits Your API Strategy?

Drawing from on-the-ground experience in China’s top pharma clusters, this guide cuts through the jargon to reveal when to partner for complex innovation and when to buy from the workhorses of mature production.